Numbers That Matter: US economy outperforms expectations in 2024

main text

Numbers That Matter: US economy outperforms expectations in 2024

whitehouse.gov

If there is a positive aspect to the interminable period between the election and the inauguration of a new president, it is that it affords one the opportunity to reflect on the previous year. So rather than distract myself with either online shopping or ruminations of what the New Year will bring, I am instead trying to sharpen my hindsight on what has happened during the past twelve months.

Here are my major economic takeaways from 2024, or at least, here are the trends I think I can see with sufficient clarity at this time.

Barring an unforeseen catastrophe, the U.S. economy will enter 2025 with solid momentum. One of the major themes with regard to the prevailing trends in the macroeconomic indicators in 2024 is that they have consistently overperformed expectations, and it looks like they will continue to do so through the fourth quarter.

The two most publicized vital signs pertaining to the health of the economy — the stock market and the labor market — have never looked better. The stock market is trading at or near all-time highs. Of the major stock indices, the Dow Jones Industrial Index is the laggard with a gain of only 16 percent so far this year. The Russell 2000 Index is up a tidy 21 percent while the S&P 500 Index and the Nasdaq 100 Index are both up a sparkling 25 percent for the year.

It is clear the stock market approves of the election outcome. And while there is still time for a crash in 2024, it would take something disastrous to wipe out gains of this magnitude. I cannot remember anybody forecasting gains this large at the beginning of 2024, but I can clearly remember forecasts calling for the market to be flat or even down for the year.

The number of people employed is also at an all-time high, and the unemployment rate is holding steady at just above 4 percent. The pressure in the labor market is gradually dissipating as 2024 comes to an end. However, there are still sectors of the economy dealing with acute labor shortages. Here again, I cannot remember anybody forecasting a labor market this robust for 2024.

Another takeaway from this year is the stickiness of price pressures in the services sector. The overall trend in the total Consumer Price Index (CPI) this year has been downward, but it has still not decreased to the Fed's target level of 2 percent. It has recently leveled off in a range between 2.5 percent and 3 percent. This is tantalizingly close to the target, but not quite there.

The reason the overall CPI has not yet hit the target and stuck is entirely due to the price trend in the services sector. The price trend in the goods sector has been below 2 percent for several months. So, the goods producing sector has not had the ability to raise prices in 2024, but the services sector — particularly the insurance and shelter (or rents) segments — is still recording price increases.

I do not see the current price trends for either goods or services ending abruptly in the near future, though there is the possibility that the equilibrium will shift at some point in 2025. Consumers are certainly feeling the effects of the price increases. This was the major factor in the presidential election for many voters. But for now, it is just too early to determine what it will take to get the trend in overall prices down to 2 percent for a sustained period.

All of these trends in the macro data are interesting, but ultimately we want to figure out what they mean for the manufacturing sector, and particularly the plastics industry. This brings me to my final takeaway from this year.

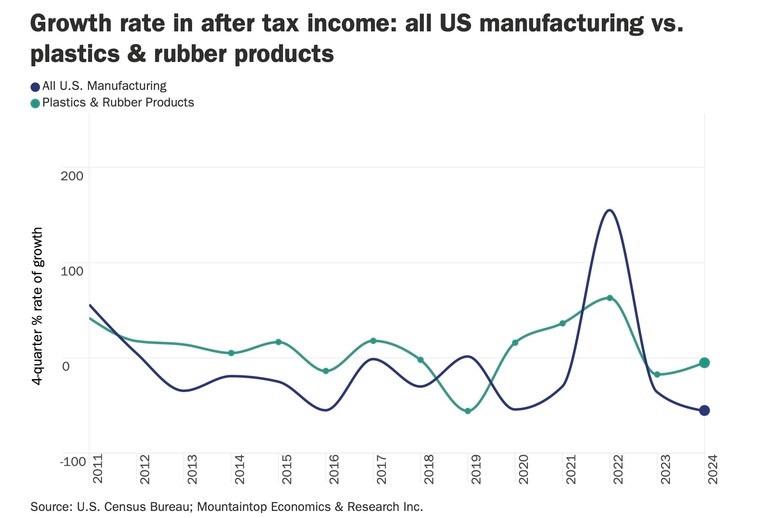

On the chart, I have graphed the rolling growth rates for after-tax income for the U.S. manufacturing sector and also the subset of the manufacturing sector represented by the plastics and rubber industries. The U.S. Census Bureau does not separate out the plastics industry from the rubber industry in this data, but for the sake of our analysis we know the rubber industry is much smaller than the plastics industry.

Both lines have been below the zero-level for the past two years, which means that after-tax incomes for both manufacturers in total and the plastics industry declined during that time. This period of decline coincided with the period of higher interest rates imposed by the Fed, so it seems reasonable to believe that lower interest rates might produce an increase in income levels.

The Fed has recently started to lower its Fed Funds Rate, but the bond market has kept real interest rates steady-to-higher. The net result is that the inflation-adjusted interest rates incurred by consumers and businesses are now at the same levels as two years ago, just about the same time the growth rate in after-tax incomes went negative.

So if the manufacturing sector and the plastics industry do indeed need lower interest rates in order to see a recovery in income levels, then that has not yet happened. Lower interest rates may very well result in an increase in demand, which in turn would create price stability, and the two of these factors combined would generate rising income for the plastics industry. But I cannot see any signs of this happening just yet.

While we wait for all of this to happen, signs of complicating forces are rapidly emerging. Not only is the stock market at an all-time high, but the price of Bitcoin just hit $100,000, the price for ruby slippers just set an all-time record at memorabilia auction, the price for a baseball star just hit an all-time high, and the value of a banana duct taped to a wall is apparently $6.2 million.

Such speculative anomalies can happen at any time, but when they start to occur at a rapid pace it often indicates we are rising up to a cyclical high point for asset valuations. I have no idea when we will get to this high point, but in the meantime, I do not think this is an environment for slower inflation and lower interest rates.

I am just going to have to wait until next year to see if my foresight improves. Until then, here's wishing you a prosperous New Year.

* Source : https://www.plasticsnews.com/news/us-economy-outperforms-expectations-2024

* Edit : HANDLER